A high credit card balance can negatively effect your score. Pay off as much of your credit card balances as possible. One of the quickest ways to raise your credit score is lowering your credit card balances. If you are worried that your credit score may stop you from getting the lease you want, build your credit score. However, if your score is below 660, you still have a 22 percent chance of earning acceptance. If you have a score above 680, you are likely to receive appealing lease offers. A score between 620 and 679 is near ideal and a score between 680 and 739 is considered ideal by most automotive dealerships. The typical minimum for most dealerships is 620. What Credit Score Do You Need to Lease a Car?Īccording to NerdWallet, the exact credit score you need to lease a car varies from dealership to dealership. To learn what score is needed to lease a car, continue on. In order for your lease application to be accepted, you likely need favorable credit history. GM also has zero percent financing available on some 2008 models, McDonald said, but it’s also offering $6,000 cash back on all remaining 2008s.Before you can drive off the lot in a leased vehicle, you must first fill out an application and earn approval for your lease. has said its lending arm is still making loans and leases, and Toyota Motor Corp.’s finance arm is offering zero percent loans on most of its model lineup. GM isn’t the only automaker trying to publicize that loans are available. The median FICO score is 720 on a scale that ranges from 300 to 850, according to Fair Isaac Corp. Those with lower credit scores have always had to pay higher interest rates, and that hasn’t changed, Lindland said. “It’s trying to find those places that you can still get money from that will still lend to you, and that’s the difficult part.” “Money is out there to lend if you have very good credit, and in some cases if you don’t have ideal credit,” Lindland said. Those below that have more difficulty or can’t get loans, he said. He’s hoping the campaign will bring more customers, but said his business is off 60 to 70 percent from September, which wasn’t a stellar month for him.Ĭlark said he’s been able to get financing for people with lower credit scores, around 630, if they have a good work history.

GMAC spokeswoman Gina Proia said the auto loan changes it has made “are related to the current market environment, which has reduced access to funds and increased the cost of funds.” I feel that they may not be around because they can’t borrow,” he said.Ĭlark said he’s upset that GMAC strayed from auto loans into mortgages that have defaulted, leading to its current financial problems. “In the past, GMAC was there rain or shine. GMAC appears to be abandoning dealers and getting out of the auto loan business altogether, said John Clark, president of Avenue Chevrolet in Batavia, Ill., a Chicago suburb. “That’s where the dealer has to be able to step up and get local financing, using their local contacts.” “They can’t really rely on GMAC any more,” said Rebecca Lindland, an auto industry analyst with the consulting company Global Insight. GM sold 51 percent of GMAC to Cerberus Capital Management LP in 2006 but still owns the rest.

CREDIT SCORE NEEDED FOR GMAC FINANCE PLUS

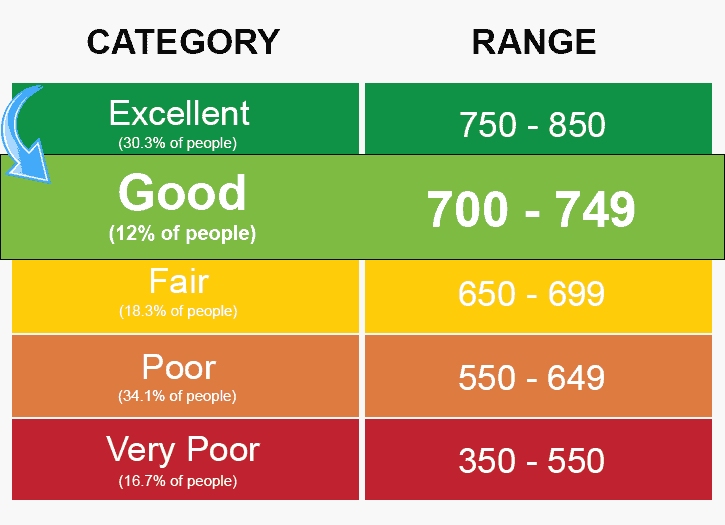

GM, analysts say, has to fight the overall impression that there’s no credit, plus tighter credit standards from GMAC. “I think the industry has been so paralyzed by the mistaken impression by the public that they can’t get an auto loan that they have to go to pretty drastic measures to counter that,” said Jack Nerad, executive market analyst for Kelley Blue Book. Some dealers have reported losing 20 percent of their sales as buyers get turned down for loans after agreeing to purchase vehicles. sales to be lower than in September, when automakers sold fewer than 1 million vehicles for the first time in 15 years. Several analysts are projecting October U.S. That, coupled with numerous news stories about people getting turned down for car loans, has kept customers away from showrooms, according to industry analysts. GMAC said Monday it would only make auto loans to people with credit scores of 700 or above. The program, called “Financing that Fits,” will publicize a 6-year-old computer database that lets dealers locate banks, credit unions and other lenders willing to make loans based on a particular buyer’s credit information. GM will promote its financing options with radio, newspaper and digital advertising from Friday through Nov.

0 kommentar(er)

0 kommentar(er)